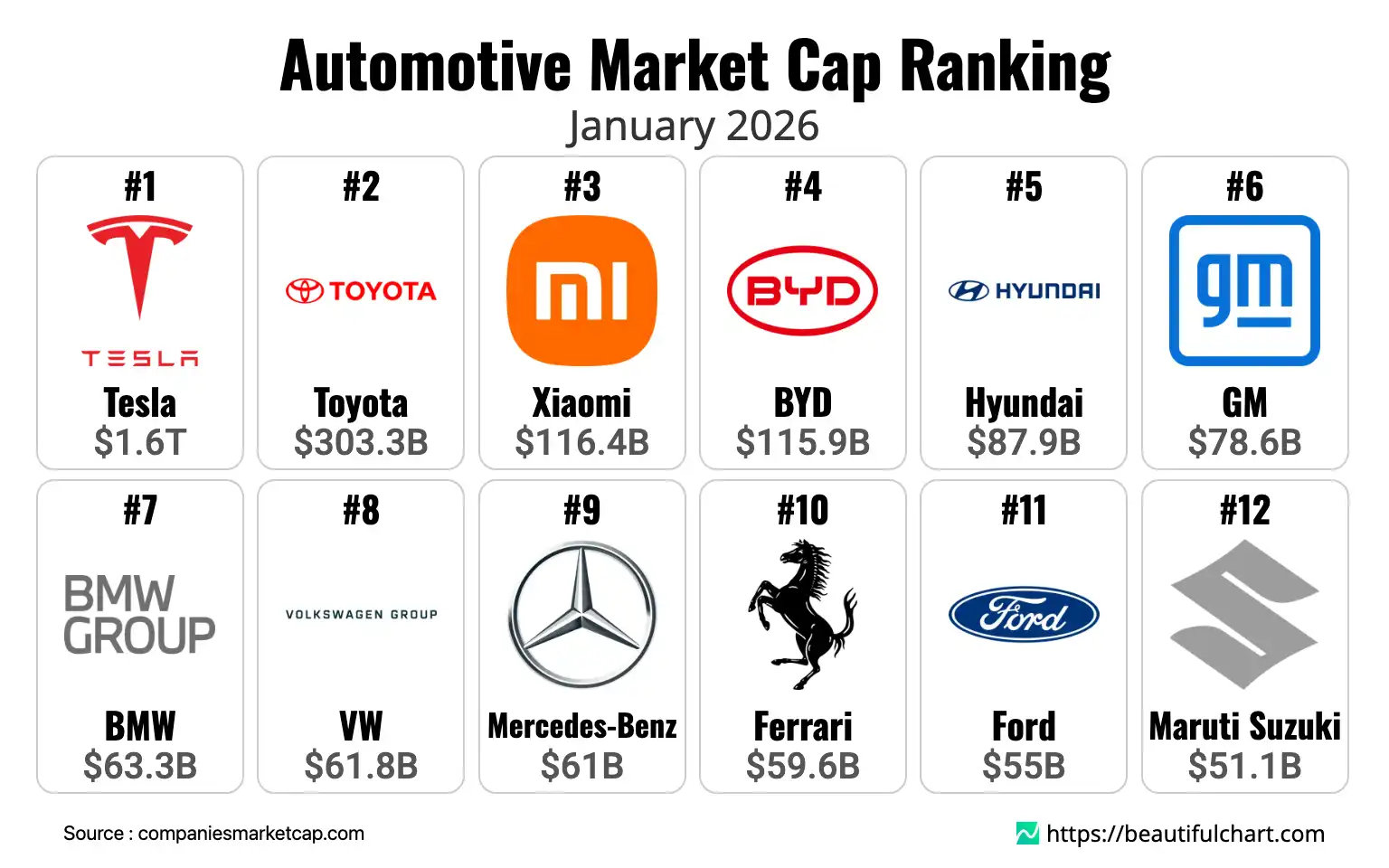

In the 2026 ranking of automotive companies by market capitalization, Tesla stands as the undisputed leader with a valuation of $1.6 trillion. This figure creates a significant gap between the American EV giant and the second-ranked traditional automaker, Toyota, valued at $303.3 billion. The rankings also highlight the rise of new players, with tech company Xiaomi and EV manufacturer BYD securing top spots, indicating a major shift in the industry landscape. The data visualizes a clear hierarchy in the global automotive market, where technology and electric vehicle specialization are key drivers of value.

Market capitalization, often called market cap, represents the total dollar value of a company's outstanding shares of stock. It is calculated by multiplying the total number of a company's outstanding shares by the current market price of one share. This figure is used by the investment community to determine a company's size and is a key metric for assessing its value and investor confidence.

The global automotive landscape in 2026 is a story of profound transformation, defined by a stark valuation divide between technology-driven newcomers and established legacy manufacturers. At the center of this narrative is an unprecedented level of dominance by one company, signaling a fundamental shift in what defines value in the industry. The hierarchy is no longer solely determined by production volume or historical brand prestige, but by perceived technological leadership, software integration, and future growth potential.

The Trillion-Dollar Anomaly: Tesla's Tech-Driven Valuation

Tesla's market capitalization of $1.6 trillion is not just a leading figure; it is a figure that redefines the industry itself. This valuation, which surpasses the combined worth of многочисленных of its closest competitors, is more akin to that of a major technology firm than a traditional car maker. Investors are not just valuing the company based on the number of vehicles it produces, but on a vertically integrated ecosystem. This includes its proprietary Supercharger network, advancements in autonomous driving technology through its Full Self-Driving (FSD) program, and its growing energy storage and generation business. The American company's success has forced a reevaluation across the entire sector, proving that a car can be a sophisticated software platform on wheels. This tech-centric valuation model stands in sharp contrast to the more conservative, earnings-based valuations of legacy automakers, explaining the vast gap between Tesla and the rest of the pack.

The New Contenders: China's EV and Tech Onslaught

The rankings reveal a powerful new force in the automotive world: Chinese technology and electric vehicle manufacturers. The entry of smartphone giant Xiaomi into the top three is perhaps the most telling sign of this trend. It represents the convergence of consumer electronics and mobility, where the user experience, connectivity, and software ecosystem are as important as the vehicle's hardware. Xiaomi leverages its vast user base and expertise in software, with its HyperOS connecting everything from phones to cars, to create a seamless digital experience.

Alongside Xiaomi, BYD's high ranking confirms China's manufacturing and technological prowess in the EV space. As one of the world's largest producers of electric vehicles and batteries, BYD's vertical integration—from raw materials to finished vehicles—gives it a significant competitive advantage in cost and supply chain control. The presence of numerous other Chinese brands like Li Auto, Seres, and XPeng further down the list underscores the depth and dynamism of the country's EV market, which is now aggressively expanding globally.

The Legacy Giants' Crossroads: Adaptation vs. Disruption

For the world's traditional automotive giants like Toyota, Volkswagen, Hyundai, and General Motors, 2026 represents a critical juncture. While they maintain strong positions within the top ten, their valuations reflect a market that is cautious about their ability to navigate the industry's electric and digital transformation. These companies possess immense manufacturing scale, global distribution networks, and decades of brand loyalty. They are investing billions in developing dedicated EV platforms, such as Hyundai's E-GMP or VW's MEB, and are rolling out a growing portfolio of electric models. However, they also carry the immense overhead of their internal combustion engine (ICE) businesses, which can slow down their transition and impact profitability. Their challenge is to successfully pivot to the new paradigm without alienating their existing customer base or succumbing to the high-growth, high-risk model of their newer competitors. The coming years will be a test of their ability to innovate and adapt in an industry that is being fundamentally reshaped.

Key Takeaways

Tesla's Unprecedented Dominance

- Tesla's market cap of $1.6 trillion exceeds the combined value of the next several competitors, showcasing its unique position.

- This valuation underscores investor confidence in its EV technology, software ecosystem, and future growth prospects.

- The gap between Tesla and Toyota highlights a major valuation difference between EV-focused firms and traditional automakers.

The Rise of Chinese Tech and EV Powerhouses

- Xiaomi, a smartphone company, entering at the #3 position signifies the blurring lines between the tech and auto industries.

- BYD's strong presence in the top 5 showcases the growing influence and scale of China's vertically integrated electric vehicle sector.

- The high rankings of multiple Chinese firms point to the country's emerging role as a dominant force in the future of mobility.

Traditional Automakers in a Shifting Landscape

- Legacy giants like Toyota, Hyundai, and GM remain in the top 10 but face immense valuation pressure from newer entrants.

- Their market caps reflect a valuation model based on production volume and history, rather than future tech potential alone.

- The success of these companies hinges on their ability to rapidly adapt to electrification and software-defined vehicles.

Top Ranking

#1 Tesla $1.6T

As the world's most valuable automaker, Tesla's $1.6 trillion market cap reflects its complete dominance of the electric vehicle market. The company is valued more like a technology firm than a traditional car manufacturer, owing to its leadership in battery technology, autonomous driving software (FSD), and its expansive global Supercharger network. Headquartered in the U.S., Tesla has driven the industry's shift toward electrification, forcing legacy automakers to accelerate their own EV plans. Its valuation is built on investor confidence in its ability to continue innovating and scaling production globally.

#2 Toyota $303.3B

Toyota holds its position as the most valuable traditional automaker, a testament to its long-standing reputation for quality, reliability, and manufacturing efficiency. The Japanese giant has a massive global footprint and has pioneered hybrid technology with its iconic Prius line. While more cautious in its full-scale adoption of battery-electric vehicles compared to rivals, its financial stability and vast production capabilities allow it to remain a formidable force. Its valuation reflects a stable, profitable business model rooted in decades of automotive excellence.

#3 Xiaomi $116.4B

Xiaomi's entry as the third most valuable car company is a landmark event, signaling the convergence of the consumer electronics and automotive industries. Leveraging its massive brand recognition and expertise in software and user interface design from its smartphone business, the Chinese tech giant made a disruptive entrance with its SU7 electric sedan. Its strategy focuses on the 'smart cabin' experience and seamless integration with its ecosystem of devices, attracting a new generation of tech-savvy consumers and positioning the car as a connected device.

#4 BYD $115.9B

BYD (Build Your Dreams) stands as a powerhouse in the electric vehicle sector, directly challenging competitors with its rapid growth and technological prowess. A key to the Chinese company's success is its vertical integration; it manufactures its own innovative 'Blade' batteries, semiconductors, and electric motors, giving it significant control over its supply chain and costs. Originally a battery manufacturer, BYD has grown into a global EV leader, expanding aggressively in markets across Asia, Europe, and Latin America with a wide range of affordable and premium electric vehicles.

#5 Hyundai $87.9B

South Korea's Hyundai Motor Company has successfully established itself as a leader in the EV era, earning its top-five valuation through a combination of innovative design and advanced technology. Its dedicated E-GMP platform underpins highly acclaimed models like the Ioniq 5 and 6, which have won numerous awards for performance and design. Hyundai has committed heavily to an electric future while also investing in next-generation technologies like hydrogen fuel cells with its Nexo SUV. Its ranking demonstrates a successful transition by a legacy automaker into a competitive EV manufacturer.

| Rank | Name | Indicator | Subindicator |

|---|---|---|---|

1 | Tesla | $ 1T 582B | |

2 | Toyota | $ 303B 251M | |

3 | Xiaomi | $ 116B 358M | |

4 | BYD | $ 115B 850M | |

5 | Hyundai | $ 87B 927M | |

6 | GM | $ 78B 612M | |

7 | BMW | $ 63B 324M | |

8 | VW | $ 61B 754M | |

9 | Mercedes-Benz | $ 61B 22M | |

10 | Ferrari | $ 59B 577M | |

11 | Ford | $ 55B 25M | |

12 | Maruti Suzuki | $ 51B 134M | |

13 | Mahindra | $ 47B 972M | |

14 | Porsche | $ 43B 866M | |

15 | Kia | $ 40B 616M | |

16 | Honda | $ 39B 941M | |

17 | Stellantis | $ 28B 598M | |

18 | Seres | $ 26B 692M | |

19 | Suzuki | $ 26B 548M | |

20 | Great Wall | $ 25B 207M |