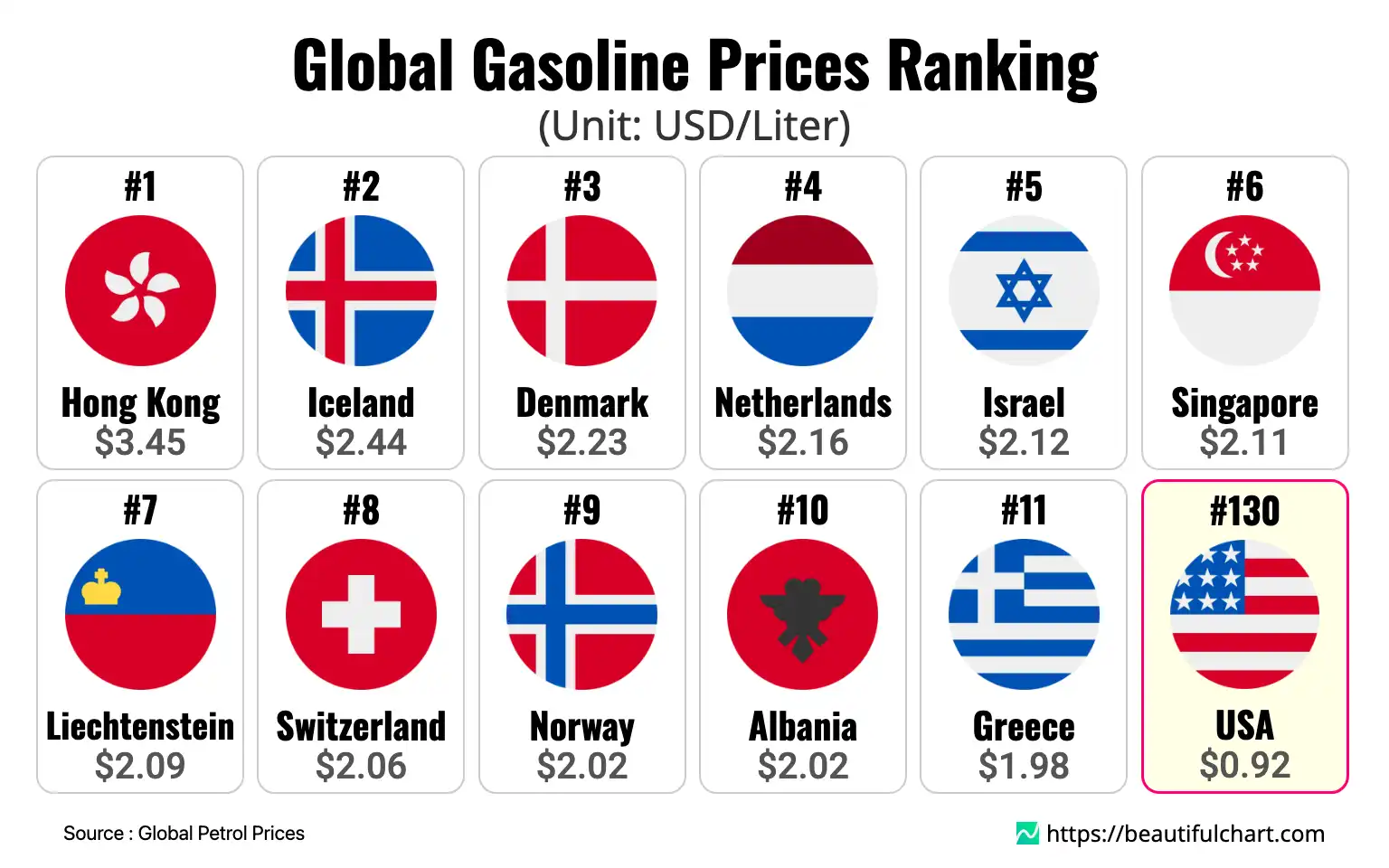

A global ranking of gasoline prices reveals a stark contrast between nations, with Hong Kong residents paying the highest at $3.45 per liter. European countries like Iceland and Denmark also feature prominently at the top of the list with prices over $2.20. Meanwhile, the United States is positioned in the lower half of the ranking at $0.92 per liter, significantly below the global average. This disparity highlights the complex interplay of taxes, subsidies, and economic factors that determine the cost of fuel worldwide.

Gasoline prices refer to the cost that consumers pay per unit of fuel, typically per liter or gallon. This price is a composite figure, influenced by the global price of crude oil, refining costs, distribution and marketing expenses, and, most significantly, government policies such as taxes and subsidies.

The price of gasoline at the pump varies dramatically across the globe, reflecting a complex web of economic policies, geopolitical influences, and market dynamics. The significant differences, ranging from over $3 per liter in some countries to just a few cents in others, are primarily driven by two key factors: government taxation and subsidies.

The Impact of Taxation on Fuel Prices

In many developed nations, particularly in Europe, high gasoline prices are a direct result of heavy taxation. Governments levy substantial taxes on fuel as a source of revenue and as a tool to discourage consumption, reduce carbon emissions, and fund public services and infrastructure. Countries like Hong Kong, Iceland, and Denmark, which top the list of most expensive gasoline, apply high excise duties and value-added taxes (VAT). These taxes can constitute more than half of the final price paid by consumers. This policy approach is often part of a broader environmental strategy aimed at promoting public transportation and more fuel-efficient vehicles. The high cost serves as a financial disincentive for driving, pushing consumers toward greener alternatives.

Subsidies and State Control in Oil-Producing Nations

Conversely, many of the world's cheapest gasoline prices are found in major oil-producing countries. Nations like Libya, Iran, and Venezuela have historically used their vast oil reserves to provide heavily subsidized fuel to their citizens. In these cases, the government sets the price far below the global market rate, often treating cheap energy as a fundamental public service or a right. These subsidies can keep prices as low as a few cents per liter, effectively insulating the domestic market from international price fluctuations. While this benefits consumers in the short term, it can lead to significant economic strain on the government's budget, encourage wasteful consumption, and contribute to smuggling as individuals attempt to sell the cheap fuel in neighboring countries for a profit.

The United States in a Global Context

The United States presents a different model. As a major oil producer itself, it benefits from a large domestic supply, which helps keep base prices relatively low. Furthermore, federal and state taxes on gasoline in the U.S. are considerably lower than in most other developed economies. This combination of factors results in a pump price of $0.92 per liter, placing it among the more affordable nations for gasoline, especially when compared to other industrialized countries. This lower cost of fuel has historically supported a car-centric culture and has significant implications for the transportation, logistics, and consumer goods industries, which rely on affordable fuel to keep operating costs down.

Key Takeaways

High-Cost Fuel Nations

- High taxes are a primary driver of expensive gasoline, particularly in Europe and developed economies.

- Governments use fuel taxes to generate revenue and encourage a shift towards public transport and energy efficiency.

- Countries with high prices often have strong environmental policies aimed at reducing carbon emissions.

Low-Cost Fuel Nations

- The world's cheapest gasoline is found in oil-producing countries that offer significant government subsidies.

- Low prices are often maintained as a public benefit but can strain national budgets and encourage overconsumption.

- These subsidies create a large price gap compared to non-producing neighbors, sometimes leading to illegal cross-border trade.

Top Ranking

#1 Hong Kong: $3.45

Hong Kong stands as the most expensive place in the world to buy gasoline. This is not due to a shortage of supply but rather a deliberate government policy of high taxation on fuel. The aim is to manage traffic congestion in the densely populated city and reduce pollution by discouraging private car ownership and use. The high price incentivizes the use of Hong Kong's extensive and efficient public transportation system. Furthermore, land is extremely valuable, which increases the operating costs for gas stations, and these costs are passed on to the consumer.

#2 Iceland: $2.44

Iceland's high gasoline prices are a result of its geographical isolation and reliance on imports for its fuel needs. Transportation and logistics costs to bring gasoline to the island nation are significant. Additionally, the Icelandic government imposes high taxes on fuel, which contribute to the final pump price. These taxes are used to fund social programs and infrastructure. The country's commitment to environmental sustainability also plays a role, as high fuel prices can encourage the adoption of electric vehicles, which are popular in Iceland.

#3 Denmark: $2.23

Denmark is another European nation where high taxes are the main component of the gasoline price. The Danish government has a strong focus on environmental policy and uses fuel taxes as a tool to reduce CO2 emissions from the transport sector. The revenue generated is invested in public services and green initiatives. This strategy aligns with the country's broader goals of promoting cycling and public transit as primary modes of transportation, making car ownership and use a relatively expensive choice for consumers.

#4 Netherlands: $2.16

Similar to its European neighbors, the Netherlands has high gasoline prices primarily due to steep excise duties and VAT. The Dutch government's 'kwartje van Kok,' a temporary tax increase from the 1990s that was never fully repealed, is a famous example of how fuel taxes can become permanent fixtures. These taxes are part of a wider strategy to manage road usage and pollution. The revenue is a critical part of the national budget, funding infrastructure projects, including the country's renowned cycling paths and public transport networks.

#5 Israel: $2.12

In Israel, the price of gasoline is regulated by the government and adjusted monthly based on international oil prices and the shekel-dollar exchange rate. A significant portion of the final price is composed of a fixed excise tax. This tax serves as a stable source of government revenue. While Israel has developed its own natural gas resources, it remains dependent on imports for crude oil, making it susceptible to global price fluctuations, which are then passed on to consumers alongside the heavy tax burden.

#130 USA: $0.92

The United States enjoys some of the lowest gasoline prices among developed nations. This is due to a combination of factors, including its status as one of the world's top oil producers and relatively low federal and state taxes on fuel compared to other industrialized countries. The vast domestic supply helps insulate the market from some of the volatility seen elsewhere. Lower fuel taxes have historically supported a car-dependent culture and are a key factor in the operating costs of the nation's massive logistics and transportation industries.

| Rank | Name | Indicator | Subindicator |

|---|---|---|---|

1 | $ 3.45 | ||

2 | $ 2.44 | ||

3 | $ 2.23 | ||

4 | $ 2.16 | ||

5 | $ 2.12 | ||

6 | $ 2.10 | ||

7 | $ 2.09 | ||

8 | $ 2.06 | ||

9 | $ 2.02 | ||

10 | $ 2.02 | ||

11 | $ 1.98 | ||

12 | $ 1.96 | ||

13 | $ 1.96 | ||

14 | $ 1.94 | ||

15 | $ 1.93 | ||

16 | $ 1.92 | ||

17 | $ 1.92 | ||

18 | $ 1.90 | ||

19 | $ 1.90 | ||

20 | $ 1.89 |