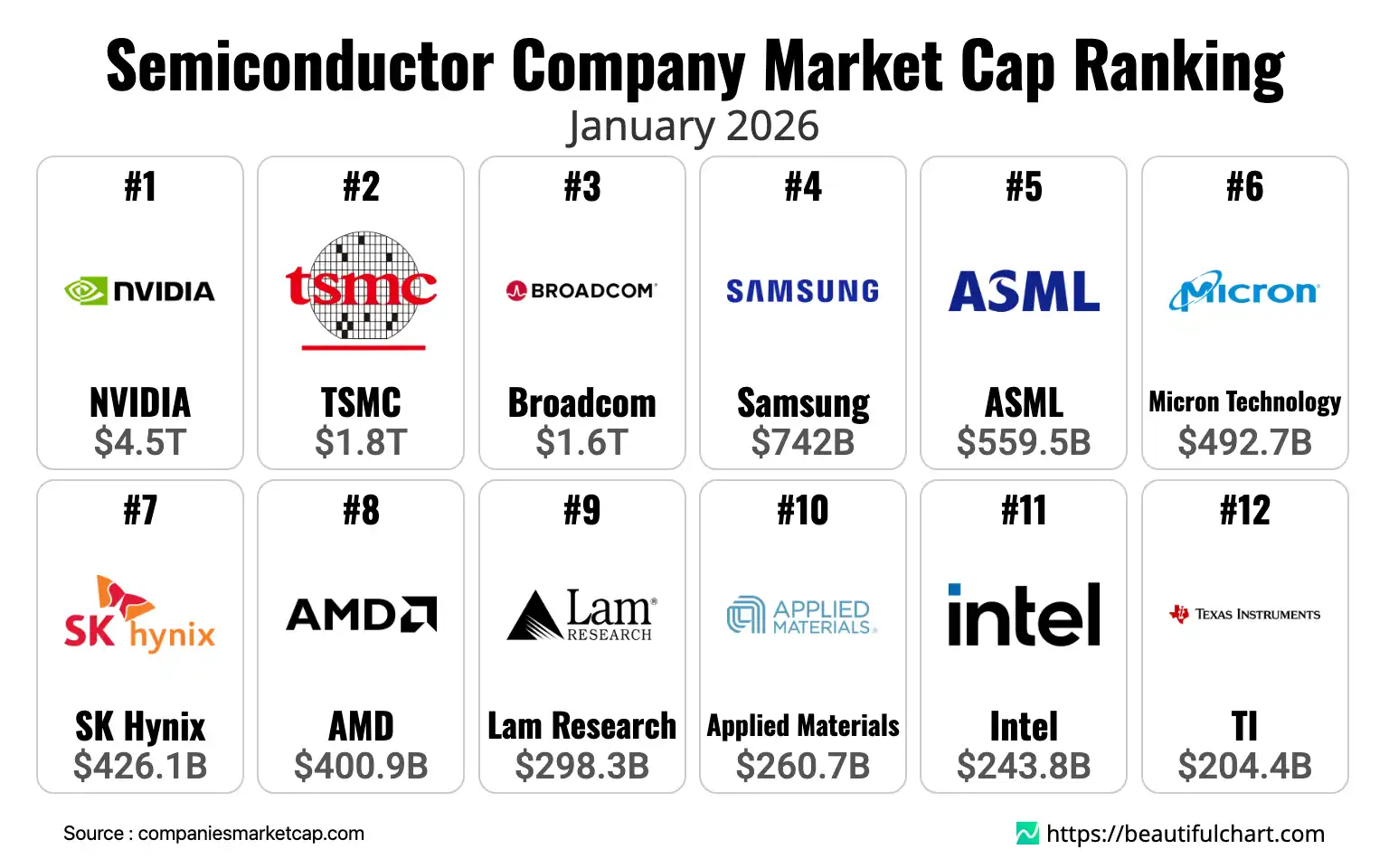

In January 2026, the semiconductor industry is dominated by NVIDIA, which boasts a staggering market capitalization of $4.5 trillion. This figure places it significantly ahead of its closest competitors, TSMC and Broadcom, valued at $1.8 trillion and $1.6 trillion, respectively. The data reveals a clear hierarchy in the market, with a few key players commanding the majority of the industry's value, while others like Samsung and ASML follow at a considerable distance.

Market capitalization, often referred to as market cap, represents the total dollar market value of a company's outstanding shares of stock. It is calculated by multiplying the total number of a company's outstanding shares by the current market price of one share. This metric is commonly used to determine a company's size and is seen as a public perception of its net worth and future prospects.

The global semiconductor landscape in early 2026 is a testament to the pivotal role of high-performance computing and artificial intelligence in the modern economy. The distribution of market value among the top companies reveals clear strategic pillars that define leadership in this critical sector. These pillars include dominance in specialized processing, control over manufacturing and the supply chain, and successful diversification strategies.

The Unprecedented Reign of AI

The most striking feature of the current hierarchy is the immense valuation of companies at the forefront of the AI revolution. NVIDIA's position is a clear indicator that the market places a premium on the technologies powering artificial intelligence. Its graphics processing units (GPUs) have become the de facto standard for training large language models and other AI workloads, transitioning from a niche for gaming and graphics to the engine of a new computational paradigm. This dominance is not just about hardware but also a deeply entrenched software ecosystem that creates high switching costs for customers. The valuation reflects a belief in sustained, explosive growth driven by the continued integration of AI into every facet of technology and business, from autonomous vehicles to drug discovery.

Manufacturing as a Strategic Imperative

Beyond the AI boom, the importance of controlling the physical production of chips is another clear trend. The high valuations of TSMC and ASML underscore this point. TSMC, as the world's leading contract manufacturer, is the silent partner behind many of the world's most successful technology brands. Its ability to reliably produce chips at the most advanced process nodes is a service that the majority of the fabless semiconductor industry depends on. This makes its business indispensable. Similarly, ASML's valuation is derived from its monopoly on a critical piece of manufacturing equipment: extreme ultraviolet (EUV) lithography machines. Without these machines, producing chips at the 5-nanometer node and below is not possible. This makes ASML a gatekeeper of technological progress for the entire industry, granting it immense pricing power and a strategic position that is nearly impossible to challenge.

Diverse Models for Success

The top tier of the industry is not monolithic. It showcases different successful business models. While some focus on cutting-edge design or manufacturing, others like Broadcom have found success through a combination of internal innovation and aggressive, strategic acquisitions. Broadcom's portfolio spans networking hardware, storage solutions, and, increasingly, enterprise software. This diversification provides a more stable revenue base that is less susceptible to the boom-and-bust cycles of specific component markets. In contrast, companies like Samsung and SK Hynix represent the traditional Integrated Device Manufacturer (IDM) model, controlling both the design and manufacturing of their products, with a heavy focus on the historically volatile memory market. Their performance is often a barometer for the health of the broader electronics industry, as memory is a fundamental component in nearly all digital devices.

Key Takeaways

NVIDIA's Unprecedented Dominance

- NVIDIA leads with a $4.5 trillion market cap, more than double its nearest competitor, TSMC.

- This valuation reflects its central role in the artificial intelligence and high-performance computing sectors.

- The significant gap between NVIDIA and other companies highlights a strong concentration of value at the top of the industry.

The Strategic Importance of Manufacturing

- Foundry giant TSMC holds the second position, underscoring the critical role of chip manufacturing capabilities.

- ASML, a key equipment supplier, ranks fifth, demonstrating the immense value of foundational technology in the supply chain.

- Companies that control key manufacturing processes or technologies command significant market valuations, as they are essential enablers for the entire ecosystem.

Diverse Paths to Market Leadership

- The top five includes a GPU/AI leader (NVIDIA), a foundry (TSMC), a diversified hardware/software company (Broadcom), an integrated device manufacturer (Samsung), and an equipment maker (ASML).

- This diversity shows that market leadership can be achieved through various business models, not just pure-play chip design.

- Broadcom's success, in particular, points to a viable strategy of growth through strategic acquisitions in adjacent markets like enterprise software.

Top Ranking

#1 NVIDIA $4.5T

NVIDIA's astronomical $4.5 trillion valuation solidifies its position as the undisputed leader in the semiconductor industry. This growth is primarily fueled by its dominance in the AI sector, where its GPUs have become the standard for training and deploying complex machine learning models. The company's strategic foresight in building a comprehensive ecosystem around its CUDA software has created a powerful moat, making its hardware indispensable for developers and researchers and driving unprecedented financial performance.

#2 TSMC $1.8T

As the world's premier dedicated semiconductor foundry, TSMC's $1.8 trillion market cap reflects its critical role in the global technology ecosystem. The company manufactures the most advanced chips for a vast client base of fabless companies, including many of its competitors in this ranking. Its leadership is built on sustained investment in cutting-edge process technology, enabling the production of smaller, faster, and more power-efficient chips that power everything from smartphones to data centers.

#3 Broadcom $1.6T

Broadcom's $1.6 trillion valuation is a testament to its successful strategy of diversification and growth through acquisition. While a major player in semiconductor solutions for networking, broadband, and wireless communication, its value is also significantly enhanced by its expansion into enterprise software and infrastructure. This hybrid model provides revenue stability and a broad market footprint, setting it apart from pure-play semiconductor firms and appealing to investors seeking diversified tech exposure.

#4 Samsung $742B

Samsung's valuation of $742 billion highlights its status as a global technology powerhouse and a leading Integrated Device Manufacturer (IDM). The company is a dominant force in the memory market (DRAM and NAND flash) and also operates a significant foundry business, competing directly with TSMC. Its diversified portfolio, which extends to consumer electronics, provides resilience, though its valuation is often influenced by the cyclical nature of the memory chip market.

#5 ASML $559.5B

ASML's market cap of $559.5 billion underscores its unique and monopolistic position within the semiconductor supply chain. The Dutch company is the sole manufacturer of Extreme Ultraviolet (EUV) lithography machines, which are indispensable for producing the most advanced semiconductor nodes. Without ASML's technology, leading-edge chipmaking would be impossible, making it one of the most strategically important companies in the entire industry.

| Rank | Name | Indicator | Subindicator |

|---|---|---|---|

1 | NVIDIA | $ 4T 519B | |

2 | TSMC | $ 1T 770B | |

3 | Broadcom | $ 1T 569B | |

4 | Samsung | $ 741B 962M | |

5 | ASML | $ 559B 472M | |

6 | Micron Technology | $ 492B 747M | |

7 | SK Hynix | $ 426B 92M | |

8 | AMD | $ 400B 937M | |

9 | Lam Research | $ 298B 307M | |

10 | Applied Materials | $ 260B 658M | |

11 | Intel | $ 243B 814M | |

12 | TI | $ 204B 449M | |

13 | KLA | $ 185B 322M | |

14 | Qualcomm | $ 163B 456M | |

15 | ADI | $ 155B 151M | |

16 | TEL | $ 121B 798M | |

17 | Advantest | $ 120B 779M | |

18 | Armenia | $ 113B 452M | |

19 | MediaTek | $ 90B 726M | |

20 | SMIC | $ 88B 533M |