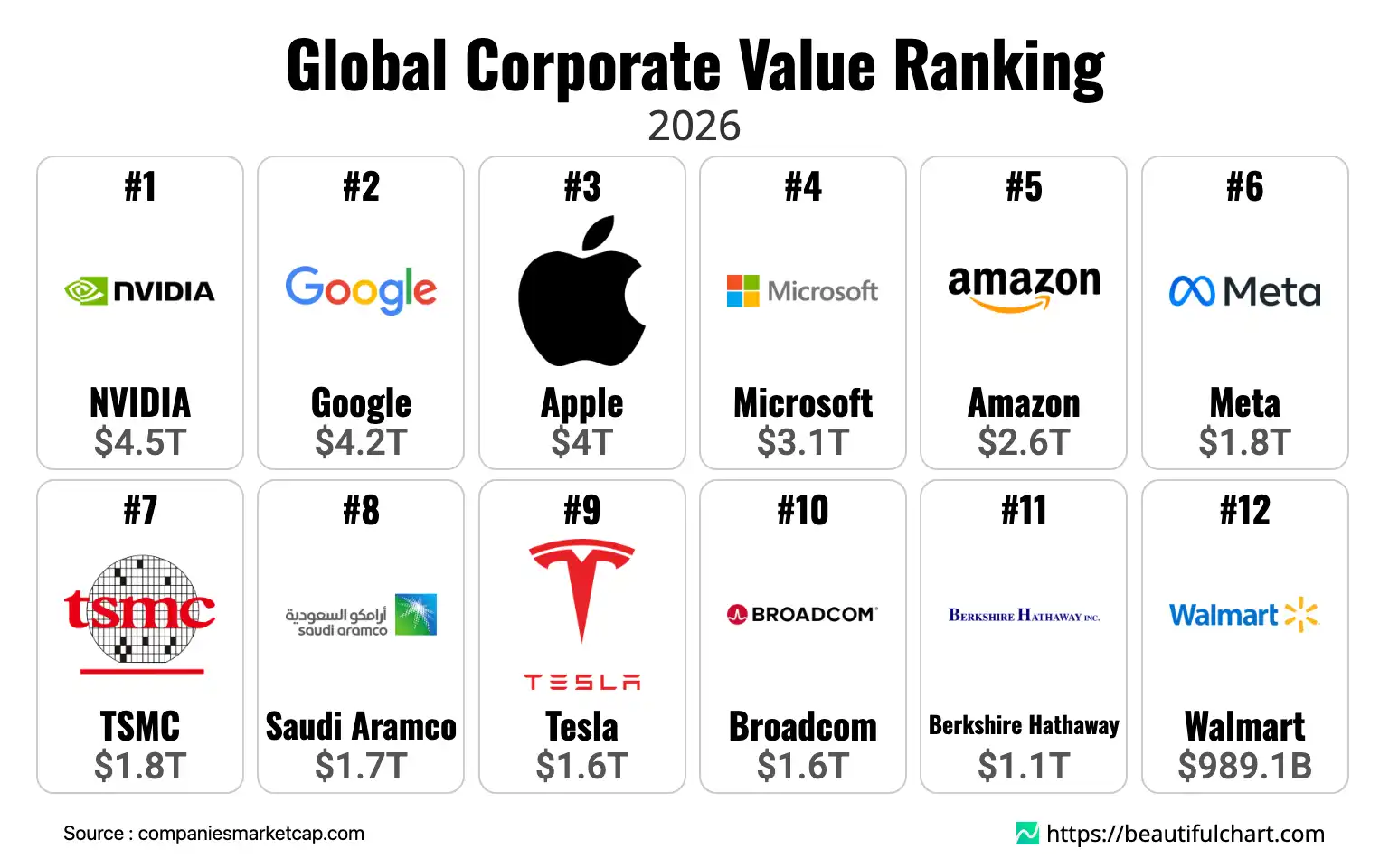

The global economic landscape is dominated by technology and American corporations. Nvidia has surged to the top position with a market capitalization of $4.5 trillion, followed closely by Alphabet and Apple. This ranking highlights the immense scale of the tech industry, with the top five companies all hailing from the United States and collectively representing a significant portion of the global market.

Market capitalization, or 'market cap,' is the total market value of a company's outstanding shares of stock. It is calculated by multiplying the total number of a company's outstanding shares by the current market price of one share, serving as a key indicator of a company's size and perceived value by investors.

The global hierarchy of corporate value reveals a distinct concentration of power within the technology sector and the United States. The sheer scale of these valuations, with numerous firms surpassing the trillion-dollar mark, underscores a new era of economic influence wielded by a select group of companies. This distribution of financial might not only reflects current market dynamics but also signals the trajectory of future innovation and global economic trends.

The Unstoppable Rise of Big Tech

The list of the world's most valuable entities is overwhelmingly led by technology titans. This trend is not a fleeting moment but the result of a sustained digital transformation that has reshaped nearly every industry. Companies specializing in artificial intelligence, such as Nvidia, have seen explosive growth, reflecting the foundational role of their hardware in the current technological boom. Similarly, firms like Alphabet and Meta continue to command immense value through their dominance in digital advertising and data. The ecosystem is further strengthened by consumer electronics giants like Apple, whose integrated hardware and software have created unparalleled brand loyalty, and enterprise software leaders like Microsoft, which provide the digital backbone for countless businesses worldwide. E-commerce platforms, led by Amazon, have fundamentally altered consumer behavior and logistics. This technological supremacy is built on a virtuous cycle of massive investment in research and development, leading to innovations that create new markets and solidify their competitive advantages through powerful network effects.

A Geopolitical Snapshot of Corporate Power

Geographically, the data paints a clear picture of American corporate dominance. The majority of the top-tier companies are headquartered in the United States, giving the nation significant influence over the global economic and technological landscape. This concentration of power in one country has wide-ranging implications for international relations, trade policy, and regulatory standards. However, the picture is not entirely monolithic. The presence of major players from Asia, such as Taiwan's semiconductor manufacturing giant TSMC, South Korea's Samsung Electronics, and China's Tencent and Alibaba, highlights the multipolar nature of the modern global economy. Europe also marks its presence with luxury goods conglomerate LVMH and semiconductor equipment maker ASML, showcasing its strength in specialized, high-value sectors. This distribution illustrates a complex interplay of regional strengths and global competition, where technological prowess and market access are key battlegrounds.

Beyond the Top Tier: Industry Diversification

While technology firms capture the headlines, a closer look beyond the top rankings reveals significant value spread across other critical sectors. The financial industry remains a pillar of the economy, with institutions like Berkshire Hathaway, Chase Bank, and Bank of America holding substantial valuations. The retail sector, represented by giants like Walmart and Costco, demonstrates the enduring power of scale and logistics in meeting consumer needs. In healthcare, pharmaceutical and biotech companies such as Eli Lilly and Johnson & Johnson command massive market caps, driven by innovation in medicine and an aging global population. The energy sector, with mainstays like Aramco and ExxonMobil, continues to be a heavyweight, reflecting the fundamental role of energy in powering the global economy. This diversity underscores the complexity of the market, where foundational industries continue to create immense value alongside the high-growth technology sector.

Key Takeaways

Tech Industry's Unprecedented Dominance

- Technology companies overwhelmingly occupy the top spots, showcasing the sector's economic power.

- The growth is fueled by advancements in areas like artificial intelligence, cloud computing, and digital services.

- Companies like Nvidia, Alphabet, and Apple lead the pack, each valued at over $4 trillion.

The Concentration of Value in US Companies

- The United States is home to a majority of the world's most valuable companies, including the entire top five.

- This highlights the country's strong position in global finance and technology.

- While the US dominates, key players from Asia and Europe also feature prominently, indicating a multipolar global market.

The Trillion-Dollar Club Expands

- A significant number of companies have surpassed the $1 trillion market capitalization threshold.

- This elite group is not limited to tech but also includes firms in finance, energy, and healthcare.

- The expansion of this club points to a broader trend of wealth concentration in top-tier global corporations.

Top Ranking

#1 Nvidia $4.5T

Nvidia has ascended to the pinnacle of the corporate world with a staggering market capitalization of $4.5 trillion. This valuation is a testament to its central role in the artificial intelligence revolution. The company's graphics processing units (GPUs) have become the essential hardware for training and running complex AI models, creating unprecedented demand. Its strategic pivot from a gaming hardware company to the engine of AI has resulted in explosive financial growth and cemented its position as a critical player in the future of technology.

#2 Alphabet Inc. $4.2T

Alphabet, the parent company of Google, stands as a titan of the digital age with a valuation of $4.2 trillion. Its dominance stems from its near-monopoly in search, which provides the foundation for a vast digital advertising empire. Beyond search, Alphabet is a leader in cloud computing (Google Cloud), mobile operating systems (Android), and video streaming (YouTube). Its continuous investment in moonshot projects and artificial intelligence through divisions like DeepMind ensures it remains at the forefront of innovation.

#3 Apple $4T

With a market capitalization of $4 trillion, Apple continues to be a dominant force in the global economy. Its success is built on a tightly integrated ecosystem of hardware, software, and services that fosters immense customer loyalty. Iconic products like the iPhone, Mac, and Apple Watch, combined with a rapidly growing high-margin services division that includes the App Store and Apple Music, create a powerful and resilient business model. Apple's brand is synonymous with quality, design, and user experience, allowing it to command premium prices and maintain remarkable profitability.

#4 Microsoft Corporation $3.1T

Microsoft's valuation of $3.1 trillion reflects its successful transformation into a cloud-centric enterprise powerhouse. Under its current leadership, the company has pivoted to focus on its Azure cloud platform, which has become a critical piece of infrastructure for businesses worldwide. Its dominance in enterprise software with the Office 365 suite, combined with strategic acquisitions in gaming (Xbox, Activision Blizzard) and professional networking (LinkedIn), gives it a diversified and formidable presence across multiple high-growth markets.

#5 Amazon.com $2.6T

Amazon's market capitalization of $2.6 trillion is built on its dual dominance in e-commerce and cloud computing. The company has revolutionized global retail with its vast online marketplace and highly efficient logistics network. Simultaneously, its Amazon Web Services (AWS) division pioneered the cloud computing industry and remains the market leader, providing the foundational infrastructure for a huge portion of the internet. This combination of a massive consumer-facing business and a highly profitable enterprise technology arm makes Amazon a unique and powerful force in the global economy.

| Rank | Name | Indicator | Subindicator |

|---|---|---|---|

1 | NVIDIA | $ 4T 519B | |

2 | Google | $ 4T 163B | |

3 | Apple | $ 3T 968B | |

4 | Microsoft | $ 3T 143B | |

5 | Amazon | $ 2T 597B | |

6 | Meta | $ 1T 786B | |

7 | TSMC | $ 1T 770B | |

8 | Saudi Aramco | $ 1T 651B | |

9 | Tesla | $ 1T 582B | |

10 | Broadcom | $ 1T 569B | |

11 | Berkshire Hathaway | $ 1T 51B | |

12 | Walmart | $ 989B 111M | |

13 | Eli Lilly | $ 936B 17M | |

14 | JPMorgan Chase | $ 838B 837M | |

15 | Samsung | $ 742B 882M | |

16 | Tencent | $ 689B 218M | |

17 | Visa | $ 642B 48M | |

18 | AstraZeneca | $ 584B 177M | |

19 | Exxon Mobil | $ 583B 655M | |

20 | ASML | $ 559B 472M |